The next 45 days should feature 2 tectonic catalysts for crypto.

One of them, the likely initial sign of approval or disapproval for a crypto spot ETF, has been discussed ad nauseam.

The other major event is the the DOJ formally charging Binance with an unknown set of crimes, and applying an unknown number of sanctions.

As crypto natives and speculators, we need to wargame the different types of damage the DOJ could inflict on Binance. The purpose of this post is to wargame Binance’s vulnerabilities. Note: I’m a speculator, not a lawyer, and would appreciate the input of criminal and securities litigators.

The accusations against Binance

Binance likely stands accused of helping Iran, North Korea, Russia etc launder the bulk of $8bn of successfully laundered crypto-funds, on top of the book thrown at US CEX’s (having a “culture of noncompliance” with regards to US securities laws, selling and marketing unregistered securities, conspiring to help US citizens evade taxes, etc).

Like Coinbase and other US-domiciled crypto institutions, Binance sees the allegations as in absurdly bad faith, and like every other offshore crypto actor, sees greater business risk in compliance with US law than in noncompliance with US law.

But, unlike US-domiciled institutions, Binance has no interest in playing the game of compliance theater that defines US TradFi compliance regulations. As Coinbase and Kraken have learned, American “compliance” has become an expensive farce which gives the US government more vectors to fine you repeatedly and cripple your business. It depends heavily on the DOJ’s good faith, which the DOJ has completely destroyed.

It’s likely that the DOJ/SEC/CFTC are demanding most or all of the below in order to secure a global settlement with US regulatory authorities:

A massive fine, which Binance wouldn’t be in a position to repay

Custody US users’ — and US funds’ — assets within the US regulatory perimeter, i.e., subject to regulatory sanction and seizure

US customers’ tax information

More onerous KYC, fund flows, and trade surveillance

Right of US government to freeze US citizens’, and US-associated foreign citizens’, on-CEX assets by US court order

Assistance in the US government’s prosecution of Tether for similar charges

Any 1 of these concessions would be a difficult pill for Binance to swallow, and any 2 would permanently jeopardize Binance’s brand or solvency. Binance shut down its segregated binance.us business to eliminate the US issues, but that didn’t mollify US prosecutors.

Binance had an all-executives-on-deck meeting in Dubai last week in which at least 4 executives’ resignations were made official: Chief Strategy Officer Patrick Hillmann, general counsel Hon Ng, US head of BD Ling Yibo, and Steven Christie, a senior compliance officer and former IRS tax enforcer. Key compliance personnel who have not resigned include Mark McGinness, Greg Monahan, Aron Akbiyikian, Nils Andersen-Roed, Tigran Gambaryan, and Matt Price. I couldn’t find any record of Zane Wong (head of KYC) still being there.

The very American skew of the resignations suggests that Binance’s legal negotiators were given a “best and final, or else” offer from the DOJ, and the “or else” is something that would severely jeopardize the careers of American executives at Binance—such as RICO charges.

Binance’s points of vulnerability

Assuming that US law enforcement is out to do maximum damage to Binance, what are Binance’s major points of vulnerability?

CZ himself. CZ is the Binance brand. Among crypto users, his commitment to crypto values, and incorruptible persona relative to his wealth, are unmatched. If CZ were arrested or renditioned by the US, Binance would be finished.

CZ likely controls a majority of the BSC validators who control the Binance Smart Chain, and thus the BSC validator whitelist.

Binance’s domain name and hosting providers. The binance.com domain could be seized by the US government. Theoretically, so could its Twitter accounts, although it’s very hard to see Twitter’s owner, Elon Musk, consenting to such a demand without putting up a serious fight. Perhaps importantly, CZ was also an investor in Musk’s LBO of Twitter. Binance’s cloud computing infrastructure is unknown; it presumably requires US dollars in order to operate, but Binance presumably has backups prepared, or maybe Binance does it all themselves.

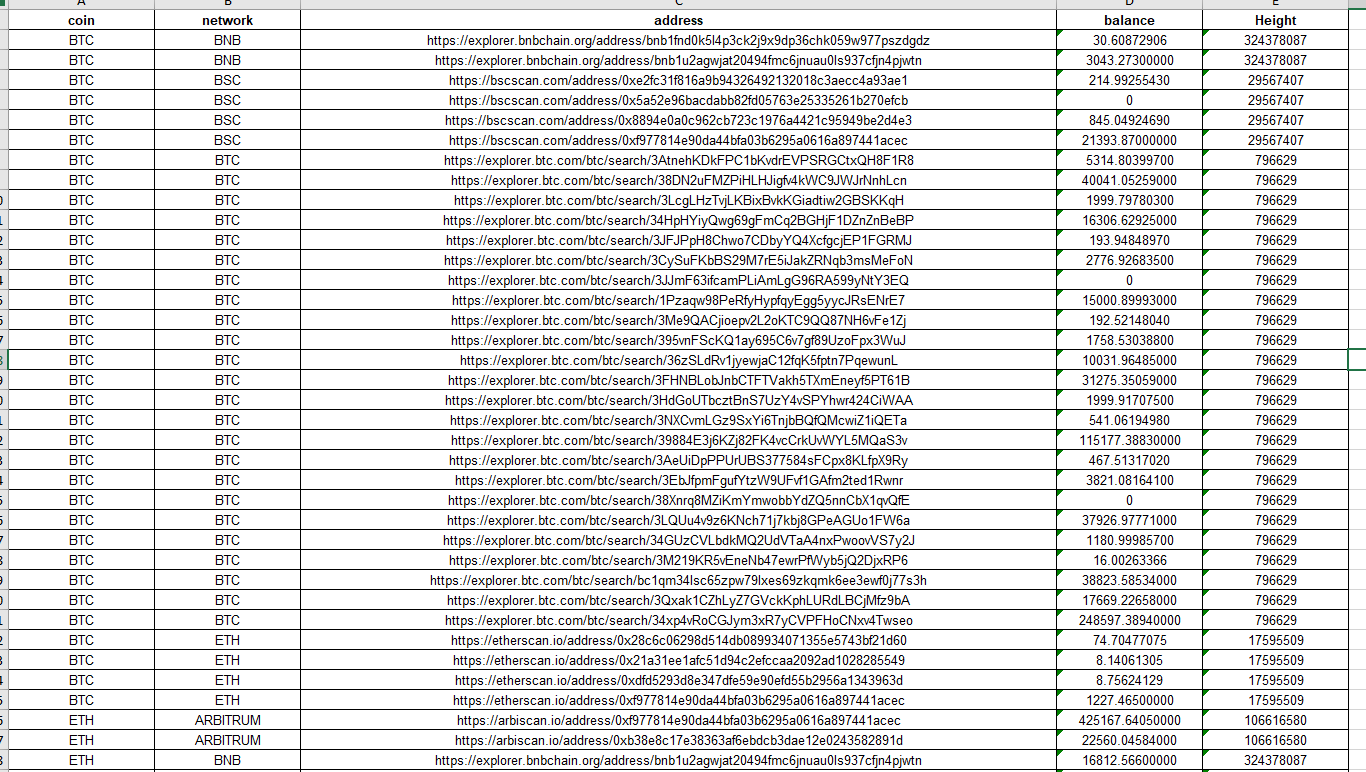

Binance’s reserves. Binance copies individual user balances to a Merkle tree of 3rd-party-and-cryptographically-verified reserves. Binance’s audited reserves today — customers’ crypto deposited at Binance, cryptographically posted to a Merkle tree which the user can verify, but independently audited by a third party on a monthly basis — stands at $108.5 billion. Almost half of these reserves are in BNB, Binance’s native token. (By comparison, Coinbase disclosed $125B of reserves in 1Q23, none of which were in its native token.)

Binance publishes balances of its top 30 or so tokens, which reside on appx. 500 Binance wallets:Binance’s operating cash flows. Binance pays its employees in BNB tokens. It also redirects a large percentage of exchange profits to repurchasing BNB tokens, closely emulating the return on capital of Chinese ADRs like NetEase which redirect a percentage of net income to dividends.

But what are Binance’s operating cash flows?

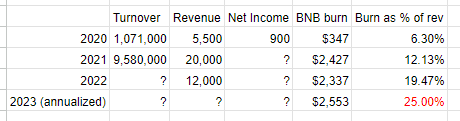

My estimates of Binance turnover, revs, and net income vs BNB burn are below:

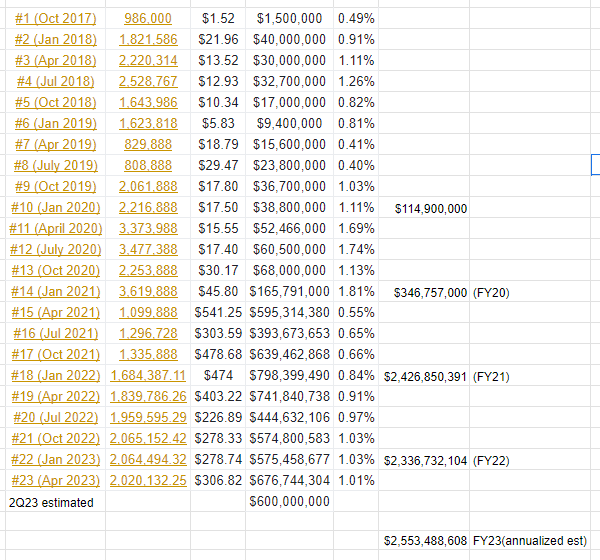

The above incorporates publicly disclosed burn data, below:

For FY21, Coinbase reported $7.8B of revenues and $3.2bn of net income - link, p117. This was with 3,730 employees by YE21

For FY22, Coinbase reported a $2.6bn loss on $3.2bn of revenue, with 4,500 employees, suggesting $4.5bn of fixed costs to run a US CEX

Coinbase paid an astronomical $1.1M of (R&D + G&A + server/hosting expense per employee); Binance’s costs would be way lower

Binance has around 8000 employees. Their employees are international, and far cheaper than Coinbase’s astronomical $1.1M of (FY22 R&D + G&A + tech. costs) per employee

It’s extremely unlikely that Binance pays as much as CB in total cost per employee, but assuming it does, it has a cost base of at most $7 billion vs Coinbase’s $4.5bn on a fraction of the volume.

Binance’s total BNB burns in 2021 were $2.4bn or 12% of reported Binance revenue

In 2022, they were little changed at $2.3bn, and are run-rating to a similar level for 2023 on lower average token prices

All of this is to say that Binance’s total revenues are likely not down by much since 2022’s $12bn, so Binance should be runrating to $~5bn of net income, of which ~25% would be redirected towards BNB burns.

This last point is important, because it mitigates a major, brewing concern:

A hole in Binance’s customer deposits? After Binance withstood the FTX crash, processed $7bn of withdrawals in one day (~10% of all deposits - a feat that a US bank couldn’t hope to accomplish) in the depth of the bear market (with CZ himself recommending that everyone withdraw money from CEXs to see which CEXs were lying about reserves and which weren’t), and then led the industry in “proof of reserves” attestation of deposits, Binance was judged to be the JPM of crypto exchanges. However, recently, a more informed narrative has emerged from legitimate industry practitioners, like Adam Cochran, who have pointed out notable, discrepancies in how Binance accounts for inventory of certain tokens. (These discrepancies allegedly total $2-4bn)

It’s worth noting that a hole could emerge for reasons having nothing to do with CZ (eg, an outside state-sponsored hack like North Korea, or even the US government). It could also happen because of offchain legal logistics in moving funds from a “cold wallet” legal entity to a “hot wallet”, although if those logistics took more than a few hours (as has been recently accused) it would be a major red flag.Binance’s “tethers” to the fiat banking system. Binance needs access to fiat banks in order to onboard new customers and allow existing customers to convert crypto back to usable fiat currency. Binance maintains relationships with banks in dozens of countries around the world, and accesses USD via eurodollar deposits. So, US regulators would have to cut off a large majority of Binance fiat partners in order to cut off Binance’s access to dollars, and/or sever Binance’s relationship with Tether.

USDT / iFinex. Binance is closely allied with 2 other key offshore crypto players: iFinex (the holdco of Bitfinex and Tether), and Justin Sun (the former Alibaba employee who now seemingly controls the TRON Network, Poloniex, the TUSD stablecoin, Huobi, and other assets). Binance relies on USDT as the default stablecoin of its exchange and employs BUSD and TUSD as last-resort backups if something happens to USDT.

Tether was the first major crypto player to face a near-death experience at the hands of the US government, for similar charges to what Binance faces today. Tether, as a superliquid stablecoin with a significant percentage of assets in non-zero-maturity fixed income, is extremely dependent upon USD access. Tether mitigated its vulnerabilities by building a very diverse range of banking relationships which it does not disclose to the market. Tether rightfully fears that any disclosure will be used against Tether by the US government, whether to hurt Tether again, or force Tether to cut off Tether’s key partners from USD liquidity.Other nation-specific crypto exchanges. CZ has significant interests in myriad nation-specific centralized exchanges all over the world. These exchanges have the ability to access foreign currency under their own name, which CZ could source liquidity from in a period of extreme USD duress.

Because of all these relationships, many in the industry believe that Binance is uniquely equipped to go toe to toe with the US government. The number of banks who’d have to be cut off from USD access in order to destroy Binance would seriously affect the USD’s level of interoperability with the global financial system, and the USD’s reserve-currency position. It would also send an extremely negative signal to supercapitalized USD holders in the Persian Gulf and elsewhere that another major round of dollar devaluation was imminent. At the same time, US regulators have shown a level of recklessness (or politicization) to date that makes such a policy blunder impossible to rule out.

OK. So: how much damage could the US, with the assistance of other friendly governments, plausibly do to Binance?

Plausible outcomes:

CZ Red Notice + USD asset freezes + sanctions of personal fiat assets. CZ is a Canadian citizen and has been for most of his life, but the Canadian government seems to have vassalized itself to the US on most crypto issues and should be assumed to cooperate with the US on this issue.

This is the market consensus, and would represent a buy the dip opportunity, imo.CZ Red Notice + Binance entities Red Notice + US RICO charges. This scenario is the most plausibly severe outcome, IMO. It would turn any American working with Binance (in any capacity other than legal counsel) into the equivalent of a Cosa Nostra mobster, and explains the mass resignation of American executives (Adam Cochran says up to a dozen executives have recently resigned; I’d be very curious as to the American skew of the larger group).

Assuming Tether ignored the sanctions, it would also make Tether a target of another wave of US attacks and would cause many of Tether’s banking partners to cut Tether off from eurodollar access in the event that Tether doesn’t cut ties with Binance.

This is the “likely bear case,” imo, but would ultimately be non-fatal, even if (in the more adverse scenario) USDT cut formal ties with Binance.

Implausible-but-possible outcomes:

Leaning on the UAE to arrest CZ for some small offense after a Red Notice, and then arranging his extraction. This would run extremely counter to the UAE’s pro-crypto policy and pro-crypto sentiment among Gulf Arab leadership, but it would also be ruinous for Binance in the short term.

Accusing Binance of actively co-conspiring with North Korea/Lazarus, Russian hackers, drug traffickers, [insert villain here], etc. While this possibility seems absurd, it would be completely consistent with the Biden/Gensler/Warren Administration’s “leave no lie behind” rhetorical pattern. Elizabeth Warren and Brad Sherman have already attempted to launder anti-crypto regulations into national security legislation. In practical terms, if this became the US official stance, it would greenlight US or US-allied cyberattacks on Binance.

The US, after all, was very likely the country that used computer malware to hijack Iran’s own nuclear centrifuges to self-destruct—while simultaneously hijacking the internal control software such that the Iranian monitoring systems couldn’t even see it happening, right under their noses. And that was 10 years ago.

This last outcome would be a disaster for US-custodied crypto exchanges, as users would be extremely incentivized to put all crypto beyond the reach of a US government that had clearly decided to destroy the institutional side of the sector.

Notably, the SEC’s accusations against Binance.us, including failure to 1:1 custody users’ assets were treated as irrelevant by the market and were mocked by the presiding judge in the case (who was an Obama appointee). Binance suffered less than $2bn of net outflows, or <2% of its deposit base.

Whatever the US government does to Binance next needs to materially impair users’ access to the service, or Binance’s interoperability with banks. If the US government cannot do that, and doesn’t resort to extrajudicial implausibles, Binance should be in the clear. However, the timing of recent resignations from Binance also suggests that a major escalation is coming.

Alex, thanks for sharing this. It's a really engaging and informative post. I mentioned it in my newsletter, I hope you don't mind! You can see what I wrote: https://cryptoiseasy.beehiiv.com/p/weekly-rundown-july-16-2023