Grace Yu, bagholder myopia, and walking the decentralization walk

Few communities virtue-signal as loudly as ATOM does re: ancap decentralization. So, why won't ATOM put its money where its mouth is?

Background

Crypto has a tendency of disproportionately attracting some of the world’s best developers. But as a token gains adoption and credibility, it attracts more and more retail investors who despise their builders the moment the subject of money comes up. The more “decentralized” a community is, the more acute this imbalance is.

Case in point: the ATOM token, the progenitor of the Cosmos SDK.

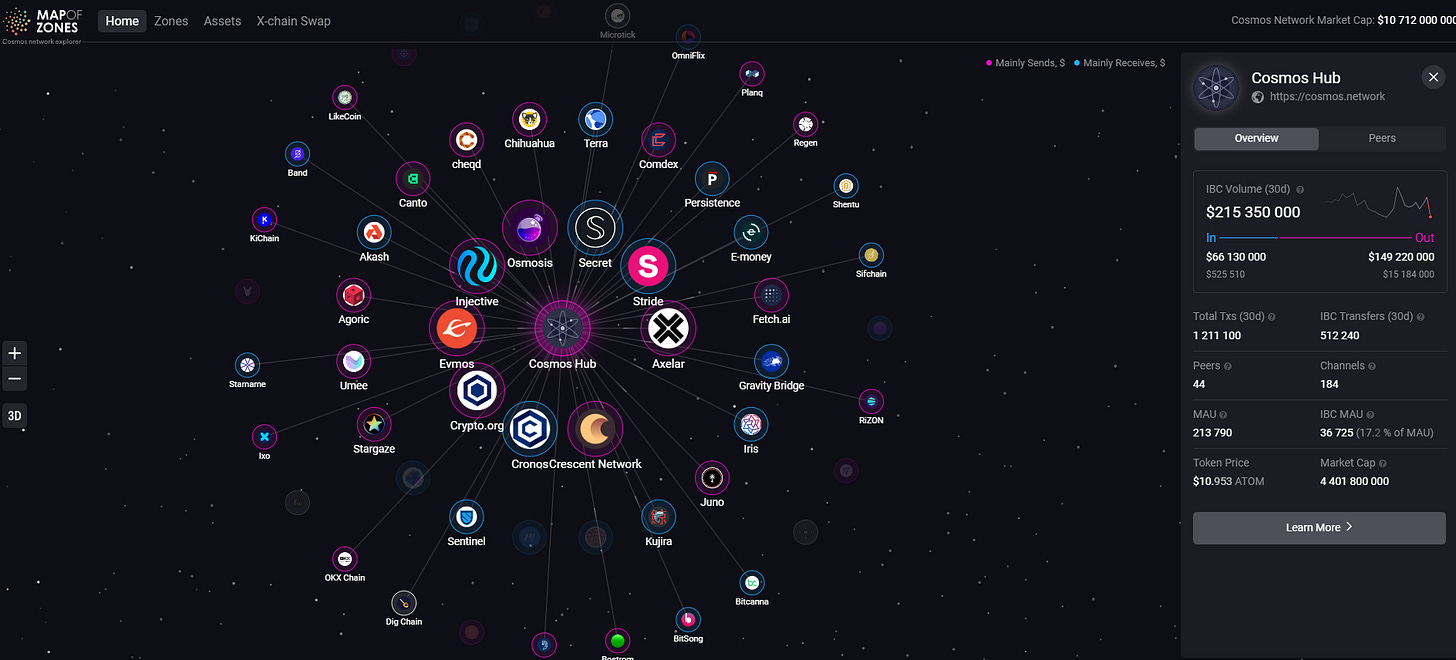

ATOM is the largest market cap token ($4.4b) in “the Cosmos,” a federation of self-sovereign blockchains running on the same underlying consensus model, Tendermint. ATOM’s goal was to create a new type of network consensus that retained the vast majority of Proof-of-Work’s decentralization while achieving consensus in a far more efficient manner, slashing gas fees and making blockchains actually usable for real-world applications.

Today, the Cosmos SDK (now encompassing 57 IBC-recognized blockchains and dozens more in development) is arguably the frontrunner in the ideological-intellectual battle among elite developers for the crown of Ethereum successor, and has steadily gained share against Eth in terms of developer activity. (While some recent comparisons have severely exaggerated the rate at which Cosmos has gained on Ethereum in terms of developer activity, it’s well-accepted that the Cosmos SDK has been gaining significant developer share against Ethereum).

Cosmos has also been around long enough to survive severe stress tests, like the Terra Protocol’s May 2022 implosion: the Cosmos ecosystem’s security, if anything, was validated as it withstood the Terra disaster (Terra was probably larger than all other Cosmos chains combined in usage and market cap at the time of its implosion).

Although the ATOM community is raucously decentralized, its central player is still AllInBits, Inc (“AIB”) the US corporate entity of the Interchain Foundation, the nonprofit legal vessel of the community founded by Jae Kwon (no relation to Terra’s Do Kwon). AIB/ICF owns around 10% of the Cosmos genesis tokens as compensation for incubating and developing the ATOM blockchain.

Jae Kwon, like many of crypto’s best developers, is a tortured genius whose more “tortured” qualities (abrasiveness, being domineering, and soliciting extremely unproductive controversy) have permanently ruptured his relationships with, and credibility among, many of Cosmos’s early-adopter builders. Kwon’s management style, and failure to establish any basic governance constraints on AIB (he made himself the sole member of AIB’s board) resulted in a 2020 corporate restructuring which essentially forked Kwon and his extremely mercurial personality out of Tendermint Inc / AIB into a new entity, Virgo, releasing the rest of AIB/Tendermint from Jae Kwon’s erratic management and behavior.

However, Jae Kwon returned to control AIB in July 2022. (I don’t know the backstory there).

Concurrent with Kwon’s return to AIB leadership, an exodus of AIB’s engineering talent began. Part of this exodus happened in January 2023 when Jae terminated the Ignite division of AIB and ensnared its leadership into signing punitive non-competes with AIB on his way out. Among Kwon’s victims was Denis Fadeev, who had been working on the Ignite product for 3 years.

Jae Kwon argued that Fadeev’s noncompete, which he probably didn’t understand, banned him from continuing work on his 3-year labor of love, the Ignite CLI and blockchain, which was a fork of Tendermint.

As the punitiveness of Fadeev’s NDA became public, Jae’s violation of basic open-source principles enraged most Cosmos builders, and a #FreeDenis movement started. AIB capitulated 2 weeks later by releasing Fadeev from his noncompete. AIB publicly climbed down after 2 weeks, although privately, Fadeev was not given a waiver for another 2 months (he received his waiver from AIB on April 2nd).

However, AIB did not extend that clemency to Fadeev’s colleagues, who had vocally criticized AIB. In fact, AIB / Kwon sued Grace Yu, Fadeev’s most vocal champion, for “relentless disparagement while promoting a competing fork of one of our products.”

The ironies were many. Among them:

AIB, the flagship of one of the most libertarian, pro-OSS crypto communities in the world, was attempting to enlist off-chain legal force to punish a key contributor.

By releasing Fadeev from his noncompete, AIB had already admitted that this “competing fork,” to the extent it competed at all, was legitimate competition.

AIB’s noncompetes additionally compelled employees to forfeit basic labor rights, which (at least between US individuals) is illegal.

Having completely lost his battle for Cosmos public opinion, Jae Kwon was turning to the threat of financial ruin to punish someone for advocating something which he’d acquiesced to.

But then something either very strange, or sadly predictable, happened: not many people in Cosmos seemed to actually care about Grace Yu’s predicament.

Many Cosmos OGs rallied behind Grace, in an exhaustively detailed proposal to the ATOM community to legally defend her (and return any unused balance of tokens back to the community). This group saw the AIB lawsuit as punishment for Grace Yu’s vocal defense of Fadeev.

However, that proposal, which basically seeks an upper bound of 50k ATOM (roughly $550k USD) for Grace Yu’s legal defense against AIB’s lawsuit, seems headed for lopsided defeat, with far more “No with Veto” votes (in which the proposal’s deposit is confiscated, usually to punish spam or other obviously malicious behavior) than “Yes” votes as of now.

As ATOM’s co-founder Ethan Buchman said (around 49:00), “This lawsuit is fucking terrible … but suing someone is by far the worst thing to have ever happened from a toxicity perspective. My fucking ATOMs, and everyone else’s, are still locked up [slowly vesting] in AllInBits, and he’s using our ATOMs to fund this bullshit.” Yet it was also Buchman’s attitude (55:00) that Grace Yu was not entitled to any community legal defense funds against a federal lawsuit which was being funded by the Cosmos community through the supposedly community-driven, but in fact Jae Kwon-controlled, AIB.

I have had very limited interactions with most of the players so maybe there’s context I am missing here, or maybe some “No” votes are lobbying AIB to drop the lawsuit, but taking everything at face value, the ATOM community is willfully blind to the chilling effect this will have on getting other builders to work with ATOM. For reasons I’m still trying to understand, this cut-off-your-nose-to-spite-your-face callousness with regard to your protocol’s employees’ interests is a feature, not a bug, of proof-of-stake communities.

The US legal system’s importance in crypto

The charitable interpretation here is that proof-of-stake crypto has attracted an extremely diverse set of users and true believers from all over the world, and many crypto users bring with them a) very low familiarity with the Western legal system and what it means for crypto’s elite builders, and b) a total disinterest in studying anything that superficially “costs them money.”

The Western legal system is basically the only legal system that functions effectively across borders between any two participating countries.

The central node of this global legal system is, of course, the United States. Which means that 99% of crypto’s contractual disputes need to be settled in US courts.

So if you are sued in US federal court, as Grace Yu has been, you have to fight the case in US court, or you lose. And this is where money really matters.

In US courts, if you are a legal attacker, there are 2 ways you can hurt someone. The hard way is by winning the case fairly. The easy way, if you have a lot more money, is besieging the defendant financially without ever having to argue the case in court. This is possible by fielding an expensive legal team which makes up every conceivable attack vector it can, and turning 1 case into a bunch of mini-cases. As the defendant, you need to respond and refute each case, which usually touches upon some slightly different area of the law. I saw this play out personally in a huge legal dispute between various members of my extended family, where one very wealthy couple leveraged a huge wealth advantage to turn a frivolous, open-and-shut case into a 6.5 year (and counting) war of financial attrition which has burned something like $15 million. And that wasn’t even in federal court!

What if the community gets the issues, but just doesn’t care?

The not-so-charitable conclusion is that — even if you have the necessary thick skin to not take every insult personally — the bottom 75% of a community is too myopically focused on its own bags to care about anything else. If one of its builders runs into legal trouble in the course of honorable business, the community is as likely to rise up in collective outrage over an imagined threat to their free lunch as it is to care.

I ran into this mentality when, in October of last year, I tried and failed to help put together a LUNC L1 team around $4m of Terra Classic community funds which were located with Do Kwon’s help. (I.e., this wasn’t even “taking money from anyone’s pocket,” it was completely “new money” that had been dumped into the community’s lap.)

A major issue that ultimately killed off the Multisig was the potential legal liability of the Multisig members. Our legal liability was that much higher because we would probably be engaged in a) creating a stablecoin, b) using funds that had a prior tangential TFL association (altho not enough to ultimately matter, it was enough to potentially litigate), and c) an extremely large, fractious community where someone was likely to sue you just because they hated you that much.

But the community view was: How f*cking dare you touch that money! That’s our money! We should be airdropped the money, and you should keep working for free!

The depth of the nastiness around this issue, and willful refusal to have any empathy for the realities of a situation that conflicted with their own misguided notions of what drove token value, was the last time I seriously considered working for the LUNC community. From that point on, I discouraged anyone who asked me from working with the LUNC community. You just can’t do business with this kind of collective mentality.

So I totally understand sentiments such as this, which based on my own experience understate what’s at stake:

https://twitter.com/bittybitbit86/status/1649489054915006464?s=20

(Ultimately, re: the LUNC multisig, the community could never figure out how to line its own pocket with the funds, so the $3-4m of funds were simply wasted. Also, the community spent another 5 months, equal to over $10 million in validator rewards plus LUNC token underperformance, fighting over how to pay for an L1 Task Force. Ultimately, stakers paid for it out of the community pool. Did the free-lunch mentality change at all, or even do the math on the cost of its wasted time? I doubt it.)

Anyway, not knowing all the interpersonal details here, potential nuances that might undermine Grace’s credibility to some parties, or possible public/private back-channel efforts to defuse the situation, it’s sad to see a similar free-lunch mentality winning the battle for ATOM hearts and minds. Like LUNC, the ATOM community seems unable or unwilling to understand what actually accretes value to a token (standing up together for what’s right; setting precedents which will attract rather than deter builder activity; and punishing predatory, anti-builder behavior.) A community is only as good as the values it defends with its wallet.

If Grace Yu is hung out to dry by the ATOM community, 1 of 2 things would happen: Grace would be personally bankrupted, or Grace would sign a humiliating and probably expensive personal settlement which would give Jae Kwon a license to legally abuse anybody else who works with ATOM in any significant paid capacity. At which point, to talented builders, ATOM would be way too much of a legal risk to even consider working with, and Jae Kwon would probably replicate this abusive behavior going forward.

It would be another major nail in the coffin for ATOM, which has been bleeding relevance in the Cosmos ecosystem for 2 years due to internal politics and misdirection. And it would be a big setback for the Cosmos ecosystem, which I really believe has a good chance to take the crown of programmatic money from ethereum over the next 5 years.